Interaction-Design.org

The folks from Interaction-Design.org have just completed their newest chapter: “Disruptive Innovation” by Clayton M. Christensen. This chapter is an excerpt from Dr. Christensen’s 1997 book “The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail

,” published by Harvard Business Press. His newer book, “The Innovator’s DNA: Mastering the Five Skills of Disruptive Innovators

,” published in 2011 on Kindle, is a follow up to the ideas in the first book and those expressed in the Interaction-Design.org chapter.

Disruptive Innovation

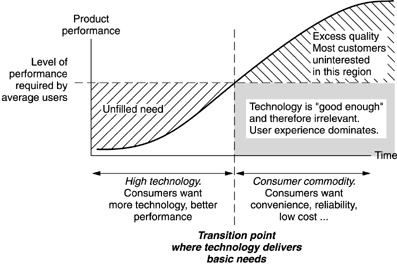

The main idea of this chapter can be summed up by Donald A. Norman’s graph (see below). This is a graph of product performance over time — think of “product” is its most expansive form. When the product is first introduced into the market, it might not be “ready for prime time”, as we say — meaning that the product is:

- difficult to use,

- or too expensive,

- or replacing a well-established way of doing things,

- or has a high learning curve: even difficult to use products can have a shallow learning curve that allows small accomplishments right away by novice users,

- or requires a large ecosystem of other products and services that are not widely available: think electric cars and recharging stations — until there are more places to recharge the car, it’s not really an option for long-distance commutes.

Early adopters might be interested in acquiring such products anyway, but most users wait until the products reached a certain level development — “Transition point where technology delivers basic needs.” And that happens when performance of the product has overcome resistance due to market acceptance, became easy-enough to operate for an average potential user, the price has dropped into an market-acceptable range, and the word has spread, so to speak.

Figure 17.1: The needs-satisfaction curve of a technology. New technologies start out at the bottom left of the curve: delivering less than the customers require. As a result, customers demand better technology and more features, regardless of the cost or inconvenience. A transition occurs when the technology can now satisfy the basic needs. Figure 2.2 of Norman (1998), modified from Christensen (1997). Copyright: Donald A. Norman. All Rights Reserved. See "Exceptions" on the page copyright notice. No higher resolution available

Clayton M. Christensen provides many examples of technologies that have surfed this technology needs-satisfaction curve, some successfully and some not. And these examples are some of the most interesting ideas presented in this chapter. It’s worth the read and I won’t repeat them here. But will present a few other examples and ideas that I thought we missing from this chapter on Disruptive Innovation. So here it goes!

Branding

Most of the time when a new product hits the market, it battles the existing brand:

- Apple II went against IBM PC, Commodore 64, and other personal computers [read more on Wikipedia]

- iPhone matched up to Motorola, Noika, Samsung, etc. [more on Wikipedia]

- Honda raced with Ford, Volkswagen, GM, and the likes [check out the cool graph of the industry on Wikipedia]

- King Kullen Supermarket went head to head with Safeway and Kroger [who’s King Kullen? read the history of supermarkets on Wikipedia]

- Nickon versus Kodak? [read more]

There are countless examples and the Chapter by Dr. Christensen provides plenty. But when do big, established brands tend to win? Aside from the graph above, there are several circumstances when the odds are in favor of known brands:

- When the desired product is very expensive, regardless of the brand, the users gravitate towards the brands they’ve heard of before. In the markets listed above, the automobile is an example — people simply don’t buy a car whose brand they’ve never heard of. Part of the decision rests on the reasoning: “I heard of the brand; the company must have been around for a while; my friends have bought the same brand; I can find the manufacturer if something goes wrong (I won’t be stuck with a lemon from an unknown producer.).” These are important considerations that outweigh slight price discounts and better performance. So to break into an expensive market, the company and the product have to be around and make themselves known to their users. Good marketing can help here.

- When the quality of the product is very difficult judge, the users again tend to pick the brand that they are familiar with. The classic example is diamond sales. Can an average consumer tell a fake from the real thing? Probably not. So when the user goes with a brand name, what they are doing is buying insurance (similar but slightly different from the case above) — De Beers is probably selling the real deal.

- When the quality of the product is culturally determined, the buyers get the leading brand. Think fashion here — for the same quality and even cut, people are willing to pay much much more for the “right” label. To break into the world of fashion, the unknown designer has to invest into marketing in addition to developing a great product. The story is similar in the art world — we pay more for the right signature.

- When the user has too much too loose, the choice is the leading brand. Diagnosed with an unusual deadly disease? You will spend the time, money, and social capital to see the best doctor in that field. Got arrested on suspicion of murder? Wouldn’t it be great to get the best attorney — worked for O.J. Fear drives the product choice when the stakes are high.

- When the choice is just not worth the cognitive energy, users choose the leading brand. Light bulbs? G.E. Salt? Little girl under the umbrella. Why spend the energy to look for something better when the good old known and familiar brand worked all those years? And was cheap too. To break into this market space, the products have to be more compelling — the light bulbs that last forever (or almost), the salt that a great chef used (you want to impress that girl). It’s hard to go against the leading brand when it is familiar and cheap.

If you compare the list above to Dr. Norman’s chart, you can see that except for the last example, consumers are willing to pay more in some circumstances. So the chart doesn’t work for products that are culturally/artistically driven, that require too much education to make the right choice, when the wrong choice produces unacceptable risks, when there’s a lack of a long term relationship combined with high price. These are the circumstances that require a different approach to disruptive technology rollout.

To learn more about branding, I would recommend a book by Marty Neumeier: Zag: The Number One Strategy of High-Performance Brands

Product Ecosystem

Sometimes the disruption requires the right set of circumstances — the right ecosystem. Nothing exists in isolation. In the example of electric car, recharging stations have to be built in order for this disruptive technology to take off. In the case of combustion engine cars, roads had to be built — and they were as part of the giant infrastructure expansion after WWII.

Intel’s MMX

So here’s a personal story of disruptive technology and ecosystem. In the early ’90s, my partner and I developed a cool product for kids: Shroom World (not the best name, but we never had an opportunity to correct that). The idea was to run full-on animation on low-end machines that were available in the elementary school classrooms at the time by deploying a hybrid system: part Internet-driven and part off the CD-Rom. And the advantage was security for the kids — no way to “get out” of the kid-friendly universe we had created. We had a very spiffy presentation and Intel was interested. We were invited to present our idea to Ms. Mona Mameesh, a Strategic Marketing Manager at the time. I should mention that Intel was peddling MMX technology — a cool new graphic chip. So here we were, telling the story of how the old puny computers in the classroom could run our software, while Ms. Mameesh was interested in selling the expensive new chip. Needless to say, our idea was a no go — it couldn’t sell their new technology and Intel wasn’t particularly interested in providing cheap educational solutions for elementary schools.

Intel was trying to develop an ecosystem for its product — the more cool 3D rotating hi-wiz games they could invest in, the more reasons consumers would have to upgrade their computers. Intel was giving money to developers, but only to the right kind of developers — the ones that helped it advance its marketing goals. The ecosystem thing.

Paxil in Japan

And here’s another story: Japan and serotonin reuptake inhibitor technology. Selling antidepressants is a billion-dollar industry in U.S. GalxoSmithKline, the maker of Paxil, saw an opportunity to open up a new market — Japan, with its 30,000 a year suicide rate! Why wouldn’t those people want the happy drug?

The problem with Japan was that it had no psychiatric ecosystem needed to sell the drug. Historically and culturally, Japan addressed the issue of metal health differently from the West. Depression was not considered a disease that was easily cured with a drug. Rather people diagnosed with depression spend over a year typically in a hospital. The Japanese media had a different take on suicide and depression — there was both an honor and dishonor associated with the disease. And there were simply no doctors to prescribe Paxil — Japan had practically no psychiatrists and virtually no research was done in this area.

To open up this market, GalxoSmithKline had to change that — it had to build a robust ecosystem to support the sales of antidepressants. It donated money for scholarships to doctors who would specialize in psychiatry; it gave money to psychological research; it supported media (writers, actors, journalists, etc.) who talked about the issues related to depression; it gave away a ton of samples; and it paid for lavish multi-national conventions (first class all the way!).

Paxil was rolled out to full cultural acceptance in 1999. In 2007, 33,093 individuals committed suicide in Japan — the second highest annual tally on record. GalxoSmithKline made a ton of money.

To learn more about Paxil in Japan and other disruptive health stories, please read Ethan Watters’ 2010 book Crazy Like Us: The Globalization of the American Psyche Free Press. ISBN-13: 978-141658708

Eating Out in Time

Dr. Christensen gives an example of McDonald’s:

The fast food industry has been a hybrid disruptor, making it so inexpensive and convenient to eat out that they created a massive wave of growth in the “eating out” industry. Their earliest victims were “mom-and-pop” diners. In the last decade the advent of food courts has taken fast food up-market. Expensive, romantic high-end restaurants still thrive at the high end, of course.

But unfortunately, that’s not the whole story. Fastfood restaurants rose about the same time as the highway system (please follow the Wikipedia link above). People started to go on driving vacations and needed comfortable places to eat — clean bathrooms, set quality, familiar food. No matter where in U.S. — and now the world — you are, you know that a big mac will be the same big mac you’ve tasted at home, it will be served the same way, it will cost the same. McDonald’s allowed the users to keep their expectations of food and restaurant experience. The familiar comforts away from home drove the disruptive technology of fastfood restaurants as much as the reasons Dr. Christensen gives above.

Setting expectations is one of the many tools we, the product designers, have in our cognitive scaffolding toolset. McDonald’s succeeded through the standardization of food experience in the age of easy travel.

But here’s another example: eating at home used to be a luxury reserved for the very rich in Ancient Rome. Why? Because kitchens were luxury items most couldn’t afford. The tiny rooms, with low ceilings were a fire hazard in an open flame cooking environment. And so people ate out. As technology improved, the social status of eating in and eating out flipped.

Oil and Gold

Fracking and smashing — what do these have in common? The price of the final product extracted, oil and gold respectively, is now high enough that these disruptive technologies make sense.

One of the first automobiles models was electric! Why did this disruptive technology didn’t take off? It was cheaper to use petroleum-based fuel. It is only now, when the prices of oil have risen high and our awareness of environmental impact of fumes have also risen high, that we are looking at electric cars again. 100 years to make the disruption!

So enjoy this very interesting chapter on Disruptive Innovation!

2 comments for “Special Preview: Disruptive Innovation”